How Spriggy works

Getting started

Connect your Aussie Visa/Mastercard debit card or bank account.

Top up your Parent Wallet

using your connected account. You can even schedule regular top ups.

Activate your kids' Spriggy card once it arrives.

Spriggy is ready to roll and your kids are ready to kick off their money-smart journey.

Activate SPRK for kids 13+

and unlock additional features designed to help give young people financial independence.

How digital pocket money works

Schedule pocket money, choose how much you want to pay your kids and how often.

They can view their balances and keep on top of how they’re managing their money.

Pocket money gets paid regularly from your Parent Wallet to their Spriggy cards or to their Savings.

Transfer money instantly from your Parent Wallet to their cards in emergencies.

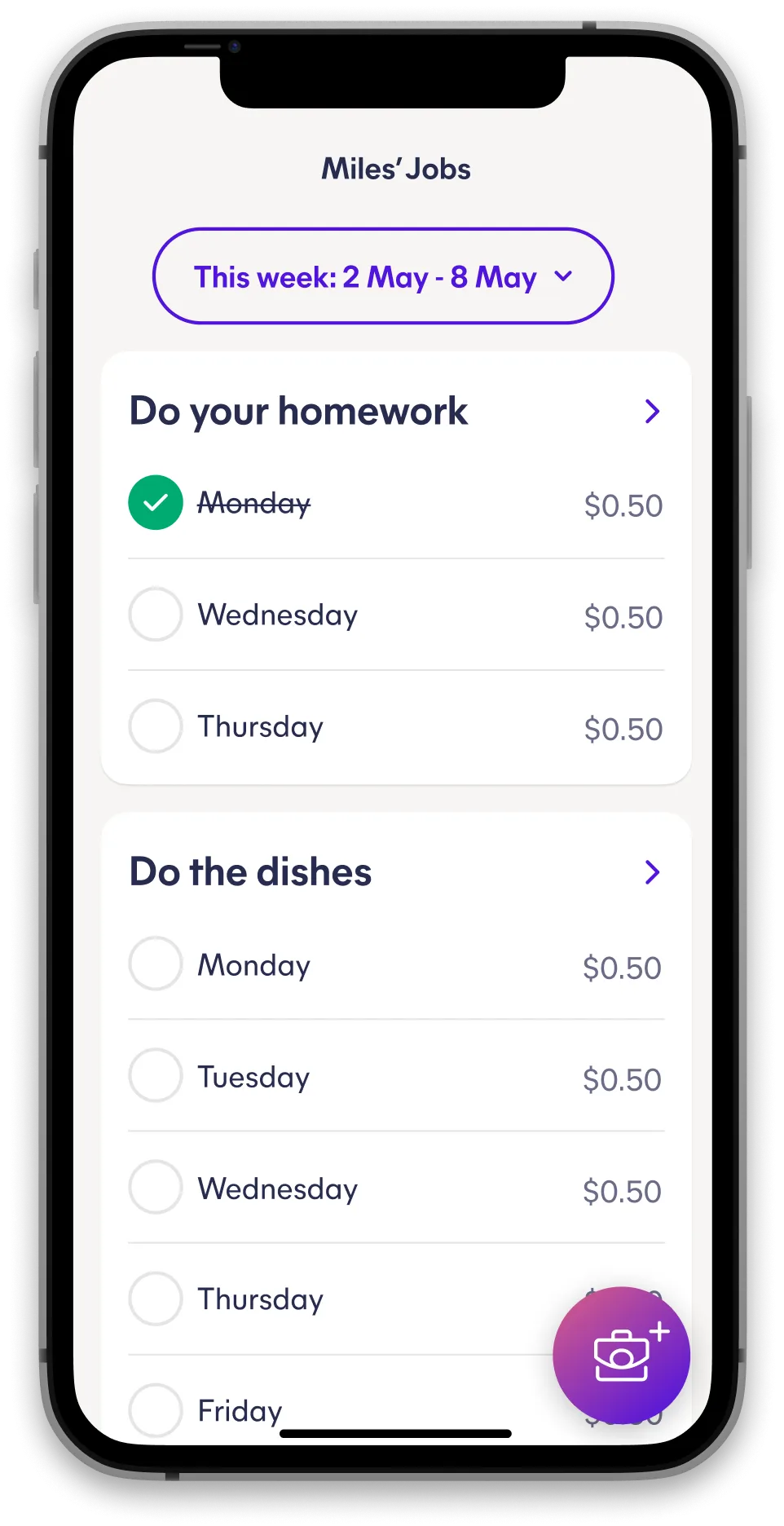

How Jobs works

Set paid or unpaid jobs for your kids so they know what chores they have to do.

They can see their jobs and tick them off once they're complete.

You approve jobs once you're happy they're done.

Your kids are paid instantly from your Parent Wallet if it's a paid job.

How Savings Goals work

Set Savings Goals with your kids so they learn to save for things they really want.

Kids contribute to goals from their Savings or Spriggy card.

Money in a Savings Goal is locked until the goal is achieved (or deleted).

You can keep an eye on their progress and even contribute to their goals.

When the goal is achieved (woo!), money they’ve saved can be moved to their cards.

How Savings Goals work

Set Savings Goals with your kids so they learn to save for things they really want.

Kids contribute to goals from their Savings or Spriggy card.

Money in a Savings Goal is locked until the goal is achieved (or deleted).

You can keep an eye on their progress and even contribute to their goals.

When the goal is achieved (woo!), money they’ve saved can be moved to their cards.

How the Spriggy prepaid Visa card works

In-store and online spending with their Spriggy cards.

You get real-time spend notifications, every time your kids use their Spriggy cards.

Transaction history helps them keep track of where their money’s going.

Merchant restrictions

block spending at tobacco shops, pubs, adults stores and other inappropriate retailers.

ApplePay for kids over 13,

Google Pay for kids over 13

SPRK mode for kids 13+

Unlock additional features for kids who are getting more independent with money.

To activate, click the Spriggy SPRK tile in-app and follow the prompts. Complete parent ID verification to unlock additional features.

Get BSB and Account No for transfers to their card ($999 card limit still applies)

Access higher total family balance ($4,999) including Parent Wallet, Savings and Goals

Kids 13+ get ATM access to withdraw up to $250 a day

Exclusive SPRK card designs for kids 13+

Instant transfers between friends using Spriggy SPRK (limits apply)

Fresh new app look and feel for kids 13+

Nearly 80% of Spriggy parents surveyed agree, Spriggy makes their kids better with money1